Investments in online advertising continued to grow last year, with display and performance-based advertising as the most popular forms again. In 2011 the internet brought in nearly CZK 9 billion in total from domestic advertisers. For 2012 we expect a 15% year-on-year growth. According to an advertising performance survey carried out by the Factum Invenio independent research agency for the Association of Internet Advertising (SPIR), the share of the internet as a media type exceeded 14% of the total advertising investments in the Czech Republic in 2011, placing third behind television and press.

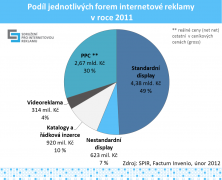

In terms of display advertising, advertisers invested CZK 5 billion in ratecard prices on the internet last year. In PPC systems (pay-per-click, performance-based advertising), advertisers spent CZK 2.67 billion in net net prices. Of the other monitored types of advertising, CZK 920 million went to catalogue and classified advertising and CZK 314 million to video advertising.

"The latest data confirm that the internet keeps strengthening its position, taking up more and more of the overall advertising. We expect the trend of growing investments in online advertising to continue in the coming years, too," says SPIR President Jan Simkanič in response to the survey results.

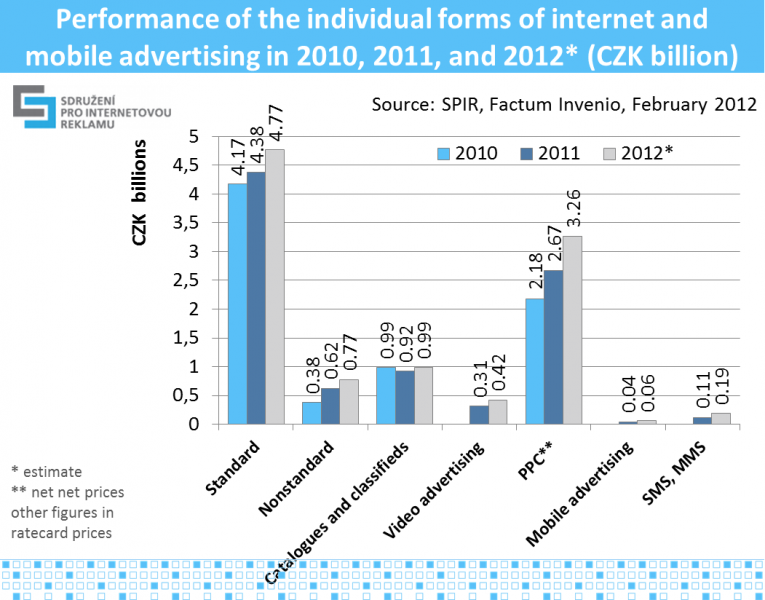

The majority (56%) is display advertising, which ranks first again with advertisers, at least judging by the ratecard prices. According to SPIR estimates, this year will see no major change in the share of the individual forms of advertising. The absolute performance of the individual types of advertising and their distribution in 2011, including this year estimate, are described in Table 1 and Chart 1.

Table 1: Share of the individual forms of online advertising in 2011 and the estimate for 2012

|

2011 |

2012 (estimated) |

Estimate of growth 2012/2011 |

|

|

Standard * |

CZK 4,378,418,000 |

CZK 4,769,108,000 |

8.9% |

|

Non-standard * |

CZK 622,635,000 |

CZK 771,889,000 |

24.0% |

|

Catalogues and classifieds * |

CZK 919,806,000 |

CZK 985,408,000 |

7.1% |

|

Video advertising * |

CZK 313,583,000 |

CZK 423,749,000 |

35.1% |

|

PPC ** |

CZK 2,666,027,000 |

CZK 3,263,994,000 |

22.4% |

* ratecard prices, ** net net prices, source: SPIR, Factum Invenio, February 2012

Chart 1

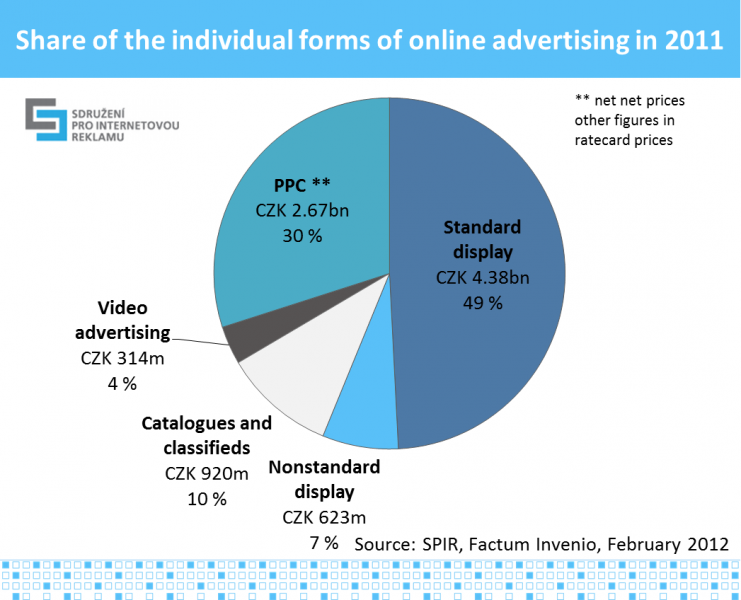

The overall advertising performance of last year comprises of display advertising in standard and nonstandard formats, of PPC advertising (search and context), catalogue advertising, classifieds, and video advertising. Given their increasing importance, mobile forms of advertising - mobile display and search advertising and SMS and MMS advertising - were also included in this year's survey. The data for SMS / MMS advertising were provided by all the 3 mobile operators. These types of digital advertising rank among the most dynamic and are expected to grow by more than 60% (Table 2).

Table 2: Mobile advertising performance in 2011 and the estimate for 2012

|

2011 |

2012 (estimated) |

Estimate of growth 2012/2011 |

|

|

SMS, MMS * |

CZK 114,027,000 |

CZK 185,185,000 |

62.4% |

|

Mobile internet advertising * |

CZK 38,945,000 |

CZK 62,511,000 |

60.5% |

* Ratecard prices

Note: Mobile advertising is not included in the overall performance of online advertising

Source: SPIR, Factum Invenio, February 2012

Estimates show that other sectors to grow significantly this year will be video advertising (+35%) and PPC advertising (+22%). Tables 1 and 2 depict the year-on-year expected growth rate based on the type of online advertising, while chart 2 shows the comparison of the absolute amounts spent on advertising based on the type of advertising in 2010, 2011 and the estimates for this year.

Chart 2

As in previous years we expects a slight drop in the share of standard display advertising this year, too, by 2.5% down to 46.7%, and an increase in the share of PPC advertising by 2% up to 32%. The real year-on-year growth of 15.3% of total online advertising expenses in 2011 came up short of last year's expectations, where the respondents had estimated a 24% growth. For this year estimates again speak of growth in the total expenditure, namely by 14.8%.

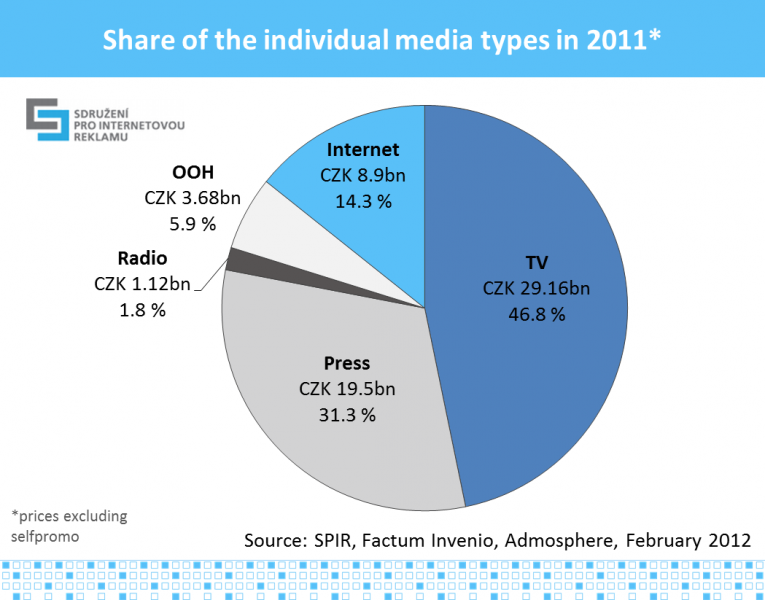

When comparing the previous year's overall internet advertising performances with the performances of other media (Chart 3 and Table 3, ratecard prices) as monitored by Admosphere, as a media type the internet with its almost CZK 9 billion placed third after television and press. The total share of the internet in all the advertising expenses totalled 14.3% last year, which is 1.5% more than the previous year 2010.

Chart 3

Note: The radio performance does not include regional sales

Table 3: Share of advertising performance of media types in 2011

|

2011 |

% of total |

|

|

TV |

CZK 29,162,723,000 |

46.8% |

|

Press |

CZK 19,500,741,000 |

31.3% |

|

Internet |

CZK 8,900,469,000 |

14.3% |

|

OOH |

CZK 3,676,360,000 |

5.9% |

|

Radio |

CZK 1,122,994,000 |

1.8% |

|

TOTAL |

CZK 62,363,287,000 |

100.0% |

Prices excluding selfpromo

The radio performance does not include regional sales

Source: SPIR, Admosphere, Factum Invenio, February 2012

Note on terminology:

PPC stands for pay-per-click. This is an advertising pricing model where advertisers pay for the visits actually brought in and not for the number of views or the time period as is the case with e.g. banner advertising or preferred catalogues. PPC search advertising is usually displayed in search engines on the right next to the search results or in premium positions. On content sites PPC advertising appears on the right or below the article.

Standard display advertising includes all the formats of banner advertising found in the internet media price lists. Nonstandard formats are not included in the lists.

Description of the methodology:

For the reasons of objectivity and sensitive data protection the Factum Invenio agency was hired for the questioning and the processing of results. Conducted in January and February 2012, the survey was based on the current annual balance of the individual entities. For the first time ever we did not work with the AdMonitoring figures to determine the display advertising performance; the performances of all the types of advertising were generated on the basis of performances declared by the individual content providers, agencies, PPC system operators, and mobile operators.

Twenty-nine of the 44 major online media addressed participated actively (66% response rate). All the 3 addressed mobile operators provided the amounts spent on SMS and MMS advertising. In order to obtain the amounts for the individual PPC systems, 3 PPC system operators and a total of 48 agencies (media, specialized SEM, web development) were addressed. One PPC system operator (Sklik from Seznam.cz) and 22 agencies actively participated, which represents a 45% response rate. To calculate the total amount spent on advertising in the PPC segment we used the weighted average of the agencies' spends in PPC systems, with the absolute spend of the particular agency as the weight. The total registered 55% return rate was relatively high for this type of survey. What is also important is that the majority of companies whose turnover has a dominant share on the market contributed their data to the survey. This is also why the presented results may be considered representative.

In order to acquire a single aggregate number for all the forms of internet advertising for the purposes of comparing it with the other media types, we were forced to add up the net netprices of the performance-based advertising with the ratecard prices of all the other forms of internet advertising. This is because performance advertising has no ratecard pricing. It would be unacceptable to increase the net net prices of the performance advertising by a hypothetical margin, improving thus the overall balance of the internet. There are no estimates of net net pricingfor the other media types available. The overall performances of the internet did not include the mobile forms of advertising.