Press Release

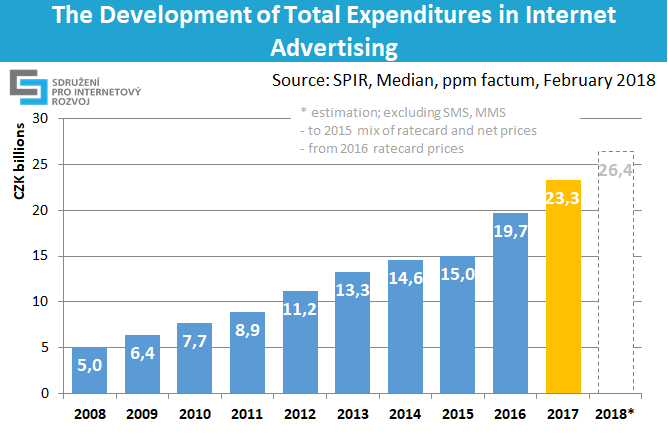

Prague, February, 27, 2018 – Last year the volume of internet advertising exceeded CZK 23 billion. Compared to 2016, this represents growth of 18 per cent caused, in absolute figures, primarily by display and search advertising. The highest relative growth was achieved by search advertising (+ 26 per cent), while classified and directories increased by 17 per cent and display advertising by 16 per cent. From the viewpoint of the manner of advertising space purchase the programmatic purchase of display advertising increased by 20 per cent, 68 per cent out of which was RTB. Expectations for the coming year are also optimistic; the survey participants assume that online advertising will continue to grow by 13 per cent up to CZK 26, 4 billion in 2018. Out of the total advertising expenditures, online advertising accounts for a 22,5 per cent share. The data come from the annual survey of Internet advertising performance conducted for SPIR by Median.

In 2017 advertisers used online advertising in the volume of CZK 23,3 billion, which is by 18 per cent more than in the previous year. “The last year’s expenditures in online advertising have confirmed its growing significance, particularly in the field of programmatic purchase that shows the most substantial increase. From the viewpoint of the advertising space in the Czech Republic, the internet has strengthened its position of the second most important mediatype,” comments Ján Simkanič, the SPIR Chairman.

Development of Total Expenditures in Internet Advertising

chart 1: The Development of Total Expenditures in Internet Advertising

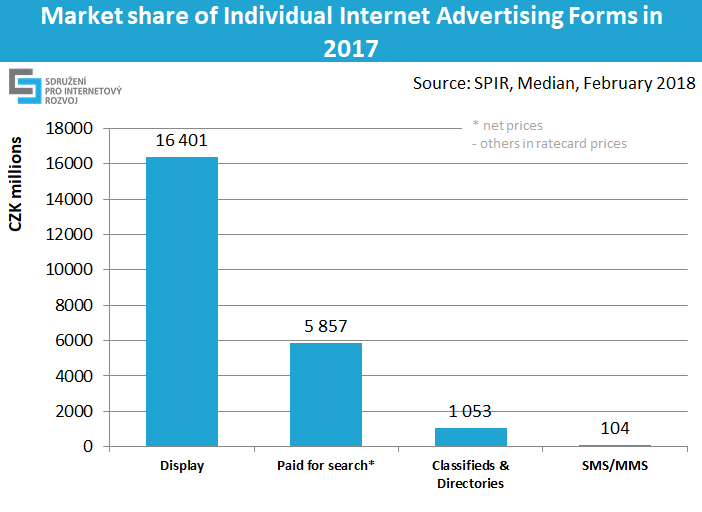

The largest part of advertising expenditures is attributable to display advertising (CZK 16,4, billion in ratecard prices), i.e. a 16 per cent year-to-year growth and the 2018 estimated increase of 14 per cent. Display advertising includes also advertising in content networks (in particular Seznam Sklik, Google AdWords and Facebook), RTB and native advertising. The second most frequently used advertising form is paid search with expenditures of CZK 5,9 billion in real prices, i.e. a 26 per cent year-to-year growth. The 2018 estimated increase of paid search is 12 per cent. The sales in respect of classifieds and directories were declared in the amount of CZK 1,1 billion in ratecard prices, i.e. a 17 per cent year-to-year growth and the 2018 estimated increase of 7 per cent. With respect to SMS and MMS campaigns, which are not being included in internet advertising, the advertisers spent CZK 104 million in ratecard prices.

Video advertising represented a 22 per cent share of the overall display advertising (CZK 3,56 billion), i.e. a 30 per cent year-to-year increase, and is expected to grow by 16 per cent in 2018. Native advertising had almost a 2 per cent share (CZK 315 million), increased four times (293 per cent), if compared to the last year, and is expected to grow by 24 per cent in 2018.

chart 2: Market share of Individual Internet Advertising Forms in 2017

The share of mobile advertising out of the overall display advertising was 17 per cent (CZK 2,87 billion), i.e. a 64 per cent year-to-year increase, and is expected to grow by 19 per cent in 2018.

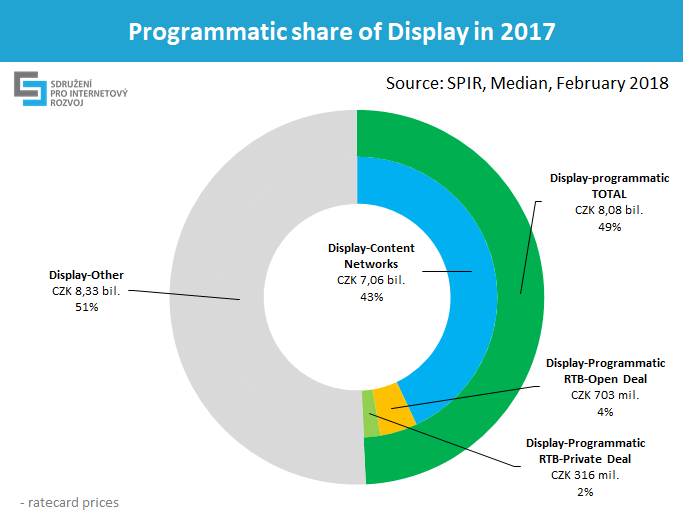

chart 3: Breakdown of display advertising according to the purchase form in 2017

Programmatic forms of advertising, which is related to content networks and RTB, together represented a 49 per cent share (CZK 8,08 billion in ratecard prices) and increased by 20 per cent, if compared to the last year. Content network reached a 43 per cent share (CZK 7,06 billion in ratecard prices + 15 per cent increase), while RTB represented a 6 per cent share (CZK 1,02 billion in ratecard prices + 68 per cent increase).

With respect to programmatic advertising, which in 2017 reached the volume CZK 7,02 billion in real prices, the highest share (87 per cent) was represented by content networks (CZK 6,14 billion in real prices). RTB share was 13 per cent with the total volume of CZK 886 million in real prices.

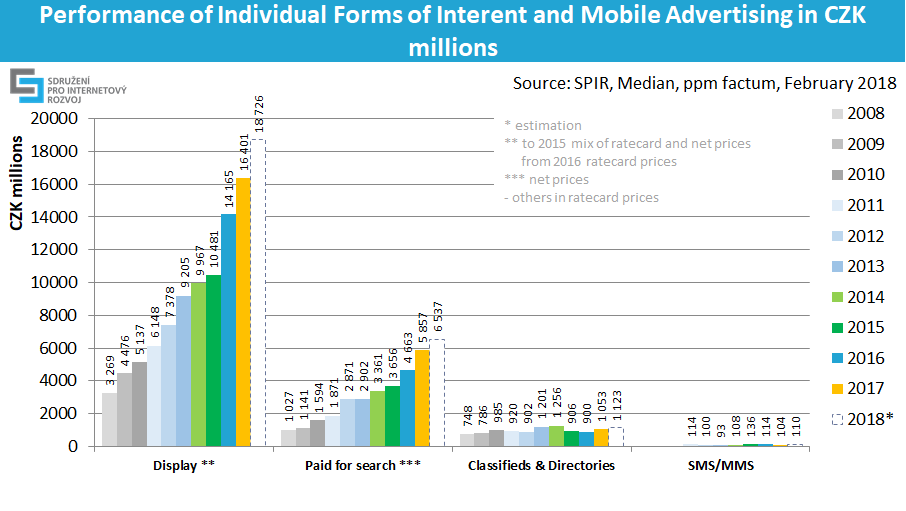

Development of Individual Forms of Internet and Mobile Advertising

The long-term growth is clearly visible in the case of display and search advertising. As far as the display advertising is concerned, the growth is caused primarily by programmatic forms – content networks and RTB.

chart 4: Performance of individual forms of internet advertising

Performance of individual forms of internet and mobile advertising in CZK ths.:

|

in thousands of CZK |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018* (estimate) |

|

Display ** |

4 475 693 |

5 137 305 |

6 148 289 |

7 378 185 |

9 204 844 |

9 967 379 |

10 481 447 |

14 164 675 |

16 400 893 |

18 725 775 |

|

Search *** |

1 141 194 |

1 593 704 |

1 871 320 |

2 871 428 |

2 901 804 |

3 360 886 |

3 656 319 |

4 663 124 |

5 857 274 |

6 536 718 |

|

Katalogy a řádková inzerce |

786 111 |

985 445 |

919 806 |

901 784 |

1 200 788 |

1 256 196 |

906 356 |

899 652 |

1 052 715 |

1 123 463 |

|

SMS/MMS |

|

|

114 027 |

99 537 |

93 264 |

107 870 |

135 947 |

113 935 |

104 150 |

110 399 |

|

CELKEM (bez SMS/MMS) |

6 402 998 |

7 716 454 |

8 900 469 |

11 151 399 |

13 307 435 |

14 584 460 |

15 044 122 |

19 727 451 |

23 310 883 |

26 385 956 |

* estimate

** ratecard and real prices mix until 2015, ratecard prices since 2016

*** real prices (net net)

the rest in ratecard prices (gross)

table 1: Performance of individual forms of internet and mobile advertising in CZK ths.

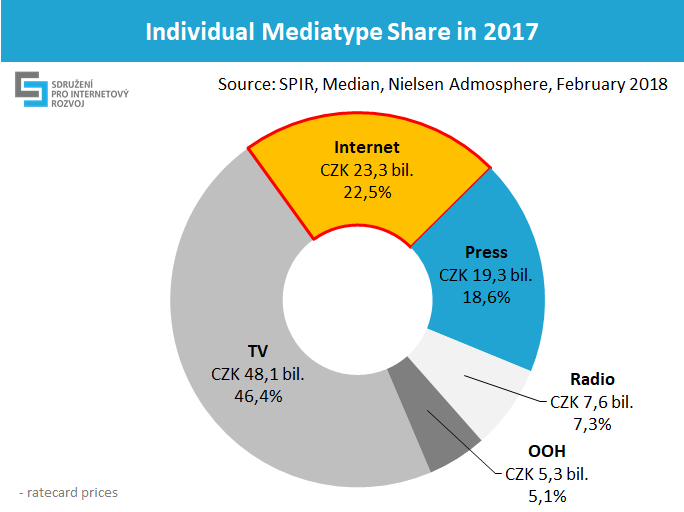

Share of Individual Mediatypes in 2017

For the purpose of comparing the volume of advertising in individual media types, data derived from the Nielsen Admosphere monitoring of advertising expenditures were used. TV advertising with CZK 48,1 billion maintains its dominant position in the advertising market (46,4 per cent). Online advertising has a 22,5 per cent share (CZK 23,3 billion). Press advertising reached CZK 19,3 billion and has an 18,6 per cent share in advertisement budgets. Radio advertising reached the level of CZK 7,6 billion (7,3 per cent) and OOH advertising generated CZK 5,3 billion (5,1 per cent) last year. The prices do not include self-promotion. Since 2008, when the SPIR online advertising performance survey started, we note a long-term growing trend of expenditures in internet advertising.

chart 5: Individual Mediatype Share in 2017

The full version of the internet advertising performance is to be found at: http://www.inzertnivykony.cz/en.

The used types of internet advertising are to be found at: http://www.inzertnivykony.cz/en/terminology-methodology.

More detailed description of advertising forms are to be found at: http://www.spir.cz/reklamni-formaty-a-html-5.

Below you will find selected terms that might be incorrectly understood from the viewpoint of terminology. A more detailed version is to be found at the above specified links.

Internet display advertising: Banner advertising in standard (banners, skyscrapers, leaderboards...) and non-standard formats (overlays, interstitials) and video banners. Now the display advertising also includes content network and RTB.

Paid search advertising: Advertising appearing on specific word requests on search engines or premium positions.

Programmatic: automated process of purchase and sale of digital advertising space. Display programmatic includes content network and RTB.

RTB (real-time-bidding) is a type of business model for selling banner advertising targeted at desired audience, where each impression is delivered in real time by automatic systems as is appropriate for the required target group. In the RTB model, geographical, linguistic or behavioural targeting of advertising is often used, on the basis of previous activity and the interests of the user. The main characteristic of the RTB model is the auction sale in real prices of advertising. Now RTB advertising is included within display advertising.

Methodology Description

For the purpose of surveying and processing the results, in the interest of objectivity and the protection of sensitive data, the Median agency was commissioned. The survey was conducted during January and February 2018 and was based on current closings of individual subjects. The performance of all types of advertising was based on declared performance of individual providers of content, agencies, and operators of advertising networks and mobile operators.

From 58 important internet operators, who were addressed, 21 became actively involved; their media have impact on vast majority of Czech Internet users. In case of 4 operators, who did not submit the results, data of AdMonitoring survey was used, 4 other operators provided their data for the last year. All 3 addressed mobile operators provided financial data related to SMS and MMS advertising messages. In order to obtain data on the performance of individual advertising networks, three operators, 54 media, digital and specialized agencies, as well as 157 direct advertisers were addressed. One operator of an advertising network (Sklik of Seznam.cz), 16 agencies and 10 direct advertisers undertook active participation. To calculate the total advertised amount in advertising networks, the claimed performance of the Sklik advertising network is used; along with the weighted average of the percentage distribution of spending by agencies into advertising networks . Breakdown of performance into search and content networks is based on declared data by agencies and direct advertisers. Operators of DSP systems were addressed in order to calculate the overall RTB programmatic advertising through shares of individual DSP with respect of agencies and direct advertisers. Taking into consideration the low participation of DSP operators the calculation was not possible, or better to say, it would be subject to significant statistical mistake. The RTB volume was thus determined as a sum of declared performance by agencies and direct advertisers.

Data up to 2016 include partial correction of prices in the case of those internet display advertising, which are obtained in real (net net) prices, because they have no ratecard prices. For the purpose of comparison with the volume of other advertising, which is indicated in ratecard prices, as well as other media types, the prices of programmatic forms (content networks and RTB) were increased by 15 per cent. The difference between a ratecard and real price is, undoubtedly, higher but because of insufficient support the minimal value was finally used.

For the purpose of transparency, volumes of programmatic forms of display advertising are indicated in real (net net) prices. Search advertising remains in real prices, and since it is not display advertising, the subsequent calculation is not necessary. The remaining media types use ratecard prices; estimates of real prices are not available. The overall performance of the internet does not include SMS and MMS campaigns, which cannot be considered as a type of internet advertising.