IAB Europe Press Release

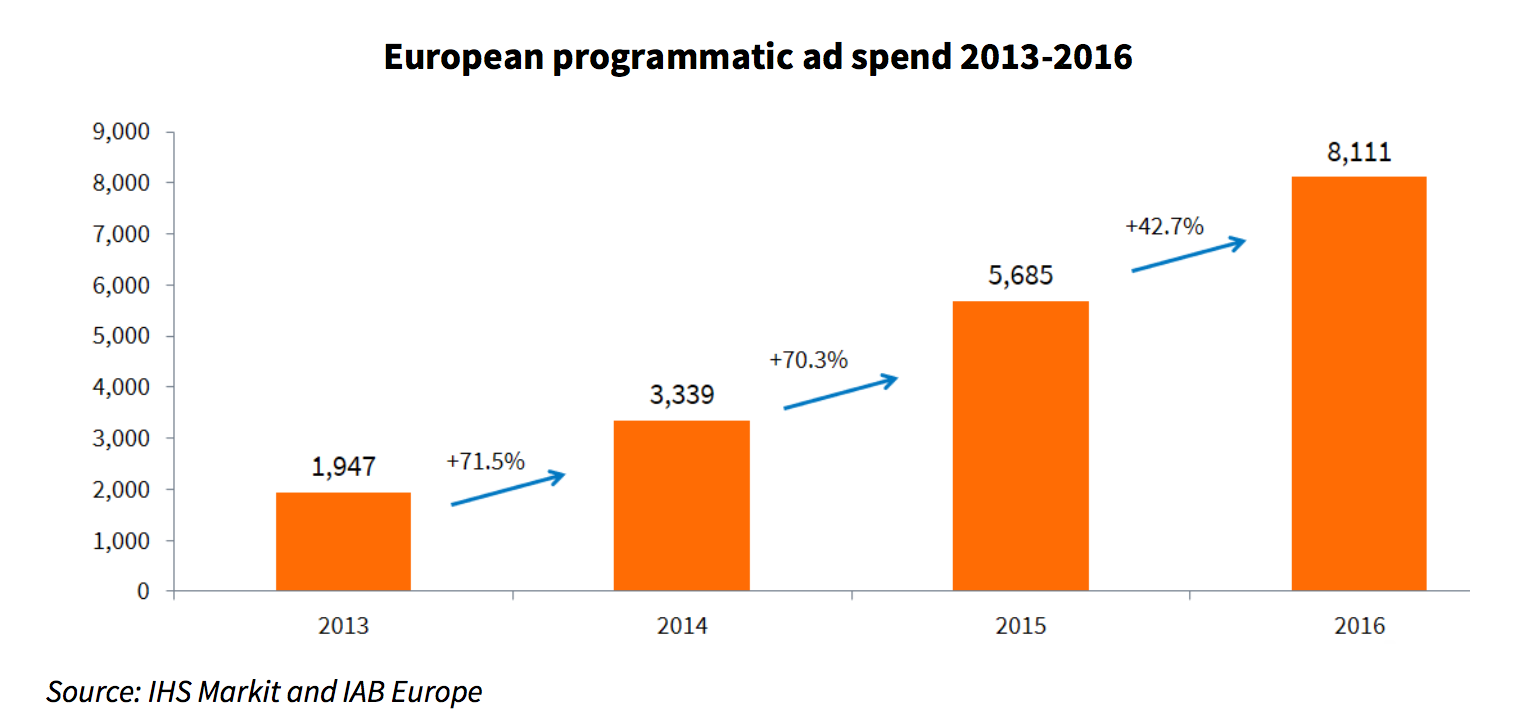

Cologne, 13th September 2017 – At dmexco today, IAB Europe in collaboration with IHS Markit announced that the total programmatic display advertising market in Europe experienced another year of double-digit growth jumping 42.7% from €5.7bn in 2015 to €8.1bn in 2016.Cologne, 13th September 2017 – At dmexco today, IAB Europe in collaboration with IHS Markit announced that the total programmatic display advertising market in Europe experienced another year of double-digit growth jumping 42.7% from €5.7bn in 2015 to €8.1bn in 2016.

The report reveals that 50.1% of European display ad spend is now traded programmatically. Additionally, programmatic video grew by an exponential 155% and now accounts for more than 45% of total online video ad spend. Mobile continues to be the ‘most’ programmatic format with 65% of mobile ad spend traded programmatically in 2016.

Whilst CEE is still small in size and maturity, it is starting to catch up and grew by 53% in 2016 compared to Western Europe which grew by 42%.

Programmatic revenues by format:

-

Mobile - €3.5bn

-

Video - €1.37bn

Programmatic revenues by region:

-

Western Europe - €7.5bn

-

Central and Eastern Europe - €0.6bn

The European Programmatic Market Sizing research is produced by IAB Europe and IHS Markit, taking a holistic approach to aggregating the data to ensure all stakeholder perspectives were included. The numbers are based on ad spend reported by IABs, transactional data, statistical and econometric models to infer a European market size and knowledge from industry experts. This programmatic research complements the IAB Europe AdEx Benchmark Report1, the definitive guide to the state of the European digital advertising market.

As programmatic becomes the primary mechanism for trading, it is important for data to be integrated into programmatic trading tools, indeed IAB Europe’s Digital Measurement Priorities Report2 reveals that more than 90% of stakeholders state that is it important for industry-agreed digital audience and effectiveness studies to be available in programmatic trading tools alongside measurement and trading data.

IAB Europe’s efforts in advancing programmatic trading across Europe with its Programmatic Trading Committee are focused on enhancing transparency and education in key areas such as mobile and data.

Daniel Knapp, Executive Director TMT at IHS Markit said: “Europe is now programmatic- first. In a big leap, programmatic transaction mechanisms have matured and enjoyed large- scale adoption, up from 18.3% of spend in 2013 to 50.1% in 2016. Adoption across Europe remains uneven, with less mature advertising markets lagging behind market leaders such as the UK or the Netherlands. Growth in online advertising now largely means growth in programmatic, but uncertainty related to the evolving EU regulatory landscape on the collection and use of data puts in question the degree to which companies will be able to realise future growth.”

Fabien Scolan, VP of Ad products, Schibsted said: "There is no big surprise to see that automated media trading is over 50%. Advertising is now living what financial trading dealt with more than 20 years ago. With the arrival of the direct guaranteed in programmatic, the revolution in media trading has ended and entered a new phase driving new ways of mastering all conversions KPIs. While large advertisers and media agencies have been the first one to face this revolution, publishers have largely contributed in making it go mainstream. For a publisher like Schibsted, the next challenge will be to have one-stop-shop automated platform that allows all advertising sales channels, business models, products and formats. Ultimately, we want to allow both top advertisers and long tail spenders to benefit from a holistic automated media trading model."

Gustav Mellentin, Co-Founder and CEO, Adform said: “While the major news in this report is the continued mass adoption of programmatic, the key takeaway for advertisers should be what this translates to looking forward. Expanded programmatic adoption across multiple channels, particularly video and mobile, pave the way for more sophisticated buying. Adoption extends far beyond traditional digital formats to include out of home, programmable TV, audio and even Print. The widespread adoption of programmatic combined with more intelligent and connected platforms enables added overall transparency and a simplification of the buying process for true people-based marketing. The industry, through consolidation and innovation, is rushing to create more unified advertising platforms that can reduce the tech tax, deliver added transparency while increasing simplicity for the media buyer.”

1IAB Europe AdEx Benchmark 2016 Report

2IAB Europe Digital Measurement Priorities Report