IAB Europe press release

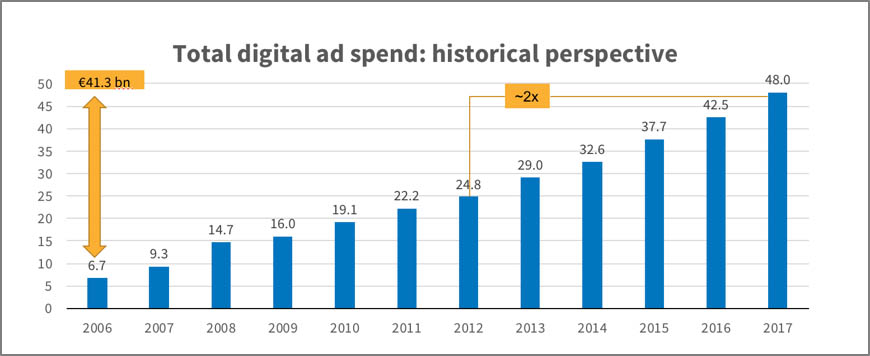

The European Digital Advertising market reached €48bn in 2017 compared with €24.8bn in 2012

The AdEx Benchmark study is the definitive guide to the state of the European digital advertising market and is now in its twelfth year. A total of twenty markets grew double-digit. Mobile dominatedwith double-digit growth in all 27 markets in the study. Mobile display grew by more than 40% and now accounts for 42% of total display advertising whilst video now accounts for more than a quarter of total display. Social grew at a similar rate at 38% and increased its share of display whilst video grew by 4x the rate of non-video display at 35%. The growth in video is driven by out-stream advertising which experienced a 73.4% growth compared with in-stream at 6.9%.

The AdEx Benchmark study is the definitive guide to the state of the European digital advertising market and is now in its twelfth year. A total of twenty markets grew double-digit. Mobile dominatedwith double-digit growth in all 27 markets in the study. Mobile display grew by more than 40% and now accounts for 42% of total display advertising whilst video now accounts for more than a quarter of total display. Social grew at a similar rate at 38% and increased its share of display whilst video grew by 4x the rate of non-video display at 35%. The growth in video is driven by out-stream advertising which experienced a 73.4% growth compared with in-stream at 6.9%.

Townsend Feehan, CEO of IAB Europe, commented “The digital advertising industry has experienced another year of strong double-digit growth in Europe confirming its role in underpinning the delivery of digital content and consumer experiences. With GDPR coming into force in just three days’ time we are at a crossroads for the industry and we must continue to improve user experiences as well as highlight the contribution that digital advertising makes to the European economy.”

The IAB Europe AdEx Benchmark study divides the digital ad market into three categories: Display, Search and Classifieds and Directories. Growth in these advertising formats has been underpinned by shifting uses in devices and changing consumption patterns.

Display advertising outperformed search and classifieds with a growth rate of 14.9% to a value of €19.3bn. Search is still the largest online advertising category in terms of revenue with a growth of 14.4% and a market value of €21.9bn.

Daniel Knapp, Executive Director TMT at IHS Markit, said “Social, mobile, video and search were the growth drivers behind digital advertising in Europe in 2017. They stand for the power of connection, location, emotion and path to purchase that make digital advertising so versatile and indispensable for today’s brands.”

The top 3 individual growth markets reveal strong growth in the CEE region:

- Belarus – 33.9%

- Serbia – 23.7%

- Russia – 21.9%

There was also strong growth in the most mature markets (in line with or above the European average) such as the UK (14.3%), Norway (16.6%), Sweden (18.4%), Switzerland (12.5%) and Denmark (9.7%) demonstrating that maturity doesn’t hinder opportunity for further innovation and growth.

Top 10 rankings (by market size)

- UK – €15.6bn

- Germany – €6.6bn

- France – €5.1bn

- Russia – €3.3bn

- Italy - €2.6bn

- Sweden– €1.8bn

- Netherlands – €1.8bn

- Switzerland – €1.8bn

- Spain – €1.8bn

- Belgium – €1bn

About the AdEx Benchmark study

The data has been compiled by IAB Europe based on information provided by the national IAB offices around Europe. It is then processed and analysed by IHS Markit. The report includes market size and value information for 2017 for the following markets: Austria, Belarus, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, the Netherlands, Norway, Poland, Slovenia, Romania, Russia, Spain, Slovakia, Serbia, Turkey, Sweden, Switzerland and the UK. The data represents the calendar year 2016 January- December. This is the eleventh AdEx Benchmark study which began in the calendar year 2006.

Display includes PC-based and mobile banners, rich media and video formats.

Explanatory note on IAB Europe/IHS Markit AdEx Benchmark figures

Each national IAB in Europe runs its own annual online advertising spending study and the IAB Europe AdEx Benchmark figures are based on these studies. As the methodology of the studies varies country by country, IAB Europe and IHS Markit have defined methodology rules to represent the figures in such a way as to make them realistically comparable. This involves:

- Readjusting local figures to allow for harmonised representation. Readjustment rates are supplied by groups of local market experts

- Estimating/harmonising ad spend data for certain formats or segments in certain countries where local IAB studies do not include data or the definition or scope of a format is substantially different from IAB Europe standardised segments

- Where local data is collected in a currency other than Euros, the average exchange rate in 2017 has been used to convert this to Euros. To provide data for prior year growth rates, the prior year figures have also been re-calculated using a constant exchange rate in order eliminate currency effects.

- AdEx Benchmark focuses on four normalised segments: ‘Display’ (including mobile display, rich media and video), ‘classifieds and directories’, ‘paid search’ and ‘other’ (including email but excluding email marketing).

- Figures quoted are gross figures (i.e. net invoiced value of the media, plus agency commission if any).